Will Institutional Adoption of Crypto Continue in 2022?

The principles and practice of web3 and decentralized protocols may be enabling the birth of a new digital world, but central to the ambition is the pivotal role of cryptocurrencies. From stablecoins to new meme coins it’s clear that cryptocurrencies have long held appeal to individual users wanting an exciting new asset which is completely decentralized. A recent report from American Banker found that only about 20% of banks in the world currently offer crypto asset consulting to their clients. However, it found nearly 40% of its banking industry respondents from around the world stated that they may begin providing crypto-asset services to their retail customers in 2022. It also makes sense that if the decentralized economy is to valuable and innovative, that the overall market value of the cryptocurrency sector must continue to rise. And institutional investment is particularly important during this current bear market phase, when the crypto market has shed more than $1 trillion in market cap since November’s high of $3.1 trillion.

It’s therefore timely to consider how the widespread adoption of cryptocurrency by institutional investors with substantial sums of money to invest could impact the ideals of decentralization in today’s crypto market. According to a 2021 Alternative Investment Management Association report, on global crypto hedge funds, nearly half of hedge fund managers with $180 billion in assets under management (AUM) were considering investing in Bitcoin. With in terms of the main obstacles to investing, regulatory uncertainty the greatest barrier (82%). So, it’s striking that the report found “64% of respondents said that if the main barriers were to be removed, they would either actively accelerate investment in digital assets.” Considering the report’s identification of regulatory impediments to greater institutional involvement in crypto, despite the risks it’s potentially good for the current bear market that the US Biden administration is due to launch a government-wide strategy for digital assets. This executive order will direct all relevant federal agencies to assess crypto’s opportunities and risks and submit their findings later in 2022. You can buy with bitcoin on amazon.

Grayscale Bitcoin Trust had been bullish on institutional investment, having witnessed an influx of almost $2 billion since October 2020, compared to outflows of $7 billion for exchange-traded funds backed by gold. However, in the current downturn it appears one of the biggest causalities has been the trust, as the $27 billion fund (ticker GBTC) has plunged nearly 17% so far in 2022, outpacing Bitcoin’s nearly 9% decline, according to Bloomberg. And just a few days ago CoinDesk reported that crypto trader Tantra, which offered an interest-bearing investment product, planned to close due to the ‘GBTC Discount’ widening to a record level.

So, what are the prospects for the future for increase institutional investment with the significant loss of value in the cryptocurrency market currently? The entry of institutional investors into the crypto industry may have accelerated the adoption of digital currencies as mainstream assets. But will institutional investors’ increased adoption of cryptocurrencies continue, or will the combined headwinds of market forces and regulatory pressures provide an obstacle to growth in 2022?

What drives institutional investors’ adoption of cryptocurrency?

Investment diversification is a significant reason institutional investors have flocked to the cryptocurrency market in search of assets to balance out their portfolio. While many of cryptocurrency’s procedures and structures compared to ‘TradFi’ are relatively still in their infancy, investors can reap various financial benefits in the long term. In similar fashion, institutional investors see it as an opportunity to enter the sector early and reap the benefits of early adopters. Perhaps one of the most dramatic examples in 2021 was El Salvador’s decision to adopt Bitcoin as legal tender. This was given a fresh twist after the president, Nayib Bukele tweeted he’d taken advantage of the current drop in BTC price, thanks to the fact that “Some guys are selling really cheap.”

On the financial management side of the investment equation the news in 2021 that BlackRock, the big news was when the world’s largest asset manager with $9.5 trillion assets, was one of 16 mutual fund managers to gain access to the crypto market via its Global Allocation and Strategic Income Opportunities funds, which have a collective worth of over $40 billion. As Forbes reported in August 2021, “BlackRock is also indirectly exposed to bitcoin via a 14.56 percent stake in MicroStrategy, the cloud software firm with over $3.4 billion of BTC on its balance sheet. MicroStrategy’s outspoken founder Michael Saylor has been one of bitcoin’s biggest champions in recent years arguing that it will soon be on the balance sheets of cities, states, governments, companies, small and big investors as well as core to tech innovation at Apple, Amazon, and Facebook.”

Protecting institutional adoption of crypto in the future

As more institutional investors enter the crypto market, it aids in the broader acceptance of digital assets by bringing more excellent stability to the space. For example, we’ve heard various statements that the most popular cryptocurrency, Bitcoin, would increase in value by a factor of 25 over the next several years due to institutional support. While institutional support appears to help crypto stability and value, crypto innovation must avoid the same mistakes traditional financial services made and remain truly decentralized.

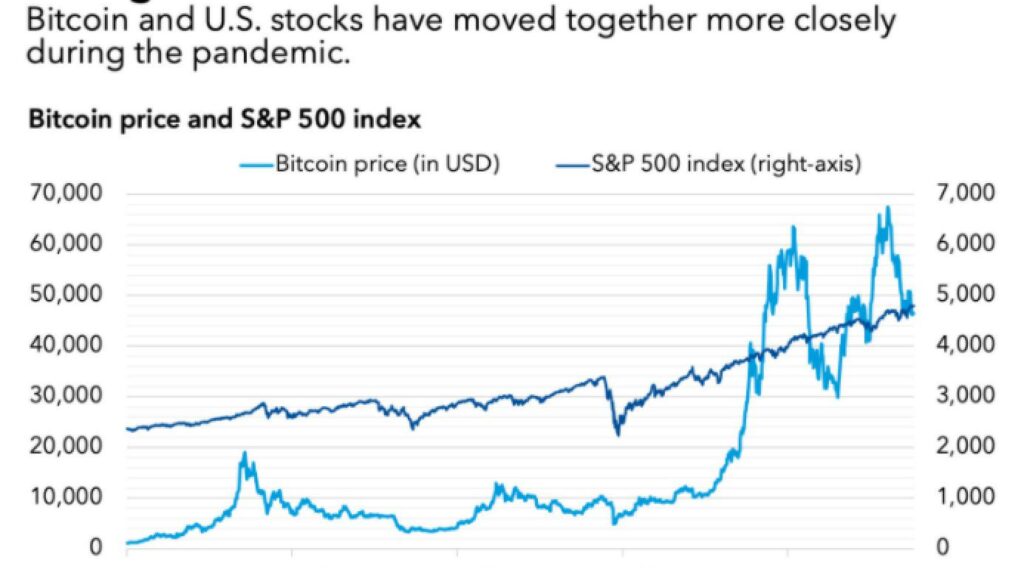

BigONE’s chairman Anndy Lian said: “As a recent IMF report showed crypto prices are increasing in sync with stocks, following the pandemic and the printing of currency by central banks; so it’s not surprising that when tech stocks declined recently, that crypto would follow suit.

“The IMF’s view is that this means less institutional use of crypto is required to diversify risk, and to avoid an increased risk of a larger market downturn as a result. While I disagree with this pessimistic attitude to crypto, I support the report’s conclusion that as regulation makes crypto safer for institutional investment, we also need a robust infrastructure to enable crypto assets to be become part of the mainstream financial system.”