Capital MBS: Looking for Business or Equipment Financing Loan?

In the dynamic landscape of business, access to timely financial resources can often be the differentiating factor between stagnation and growth. Capital MBS emerges as a beacon for businesses, offering comprehensive financial solutions tailored to fuel their expansion strategies. With a particular emphasis on equipment financing and working capital loans, Capital MBS stands out as a trusted partner for enterprises seeking to thrive in today’s competitive market.

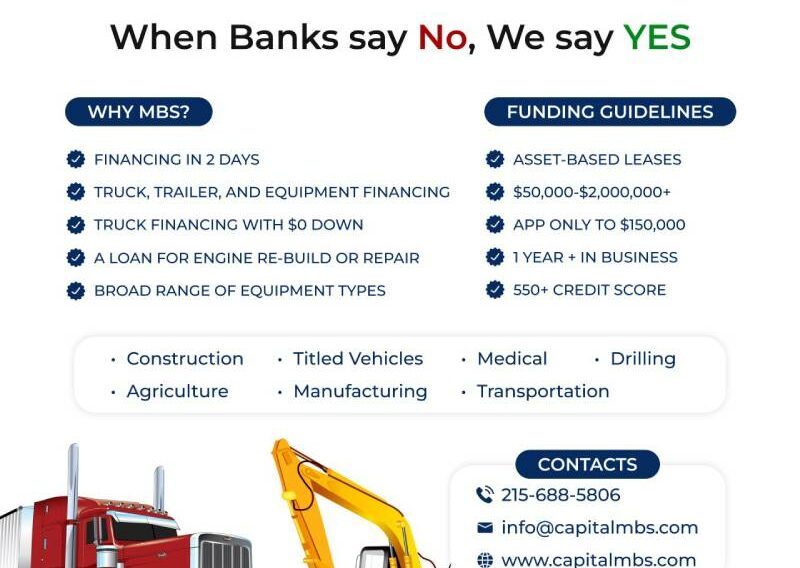

A Focus on Equipment Financing and Working Capital Loans

Capital MBS prides itself on providing clients with easy and convenient access to financial resources, ensuring that businesses have the support they need to prosper. Their team of seasoned professionals streamlines the application process, guaranteeing fast approval and personalized assistance to select the best financial solution for each unique business need. Moreover, Capital MBS offers competitive interest rates and flexible lending terms, empowering businesses to make the most of their financial resources.

At the heart of Capital MBS’s offerings lies their commitment to fast and flexible financing. Whether it’s equipment financing or working capital loans, Capital MBS assesses and selects the most suitable funding options for businesses. This versatility ensures that businesses of all sizes and sectors can find the financial support they require to thrive.

Merchant Cash Advances and Business Loans

In addition to equipment financing and working capital loans, Capital MBS provides merchant cash advances (MCA) and a variety of business loans. The MCA option offers businesses quick access to capital based on future sales, providing a flexible repayment structure that aligns with their revenue streams. This product is particularly beneficial for businesses experiencing seasonal fluctuations or those needing rapid funding to seize growth opportunities.

Versatile Funding Options for Every Need

One of the most enticing aspects of Capital MBS’s offerings is the range of funding available. From as little as $10,000 to as much as $5 million, businesses have the flexibility to access the capital they need, regardless of their scale or ambition. This democratization of funding empowers businesses to pursue growth initiatives with confidence, knowing that their financial needs are in capable hands.

Moreover, Capital MBS’s reach extends across all 50 states in the U.S., ensuring that businesses nationwide can benefit from their expertise and support. Whether nestled in the bustling metropolises of the East Coast or the serene landscapes of the Midwest, businesses can rely on Capital MBS to provide them with the financial resources they require to thrive.

Support for Diverse Business Needs

In addition to their core offerings, Capital MBS goes the extra mile to support businesses in navigating complex procurement programs. Their team analyzes, advises, and makes recommendations to qualify for contract eligibility in government minority-owned procurement programs, opening doors to new opportunities for diverse businesses.

Behind the success of Capital MBS stands Yaro Yarema, the founder with a passion for equipment funding. With a specialization in small businesses, logistics, and medical sectors, Yarema brings a wealth of expertise to the table. His guidance and support have helped numerous clients secure working capital loans and alternative business financing, while also assisting them in obtaining equipment financing, sales leaseback options, and real estate bridge loans.

Comprehensive Financial Solutions

Capital MBS’s offerings extend beyond traditional loans and cash advances. They include business lines of credit, commercial real estate loans, fix-and-flip options, and interest-only lines of credit. This comprehensive suite of financial products ensures that businesses have access to the right type of financing for their specific needs, enabling them to manage cash flow, invest in growth, and capitalize on market opportunities.

Nationwide Reach and Personalized Service

Capital MBS stands as a beacon of hope for businesses seeking reliable financial support. With their focus on equipment financing and working capital loans, coupled with fast approval, flexible terms, and nationwide reach, Capital MBS empowers businesses to thrive and prosper in today’s competitive landscape.

Whether you’re a small business in need of new equipment, a startup looking for working capital, or an established enterprise seeking to expand, Capital MBS offers the tailored financial solutions you need to achieve your goals. Trust in their expertise and commitment to help you navigate the complexities of business financing and secure the resources necessary for success.

Unlock your business’s potential with Capital MBS! Whether you need equipment financing, working capital loans, or merchant cash advances, we’ve got you covered. Don’t let financial constraints hold you back. Apply now and fuel your growth with tailored financing solutions. Visit our website www.capitalmbs.com or call us today at 215-688-5806 to get started!