Exclusive: Egypt purchases almost a portion of 1,000,000 tons of Russian wheat in private deal

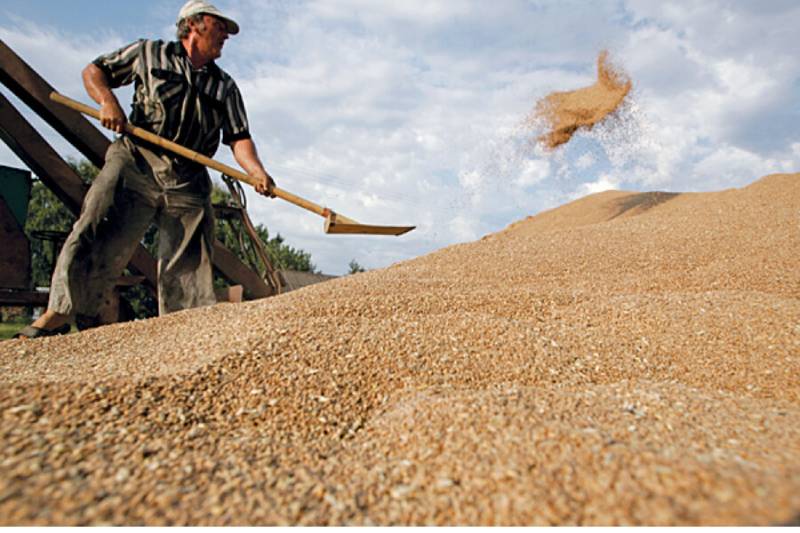

Egypt’s state grains purchaser purchased about a portion of 1,000,000 metric lots of Russian wheat in a confidential arrangement, four brokers told Reuters, prevailing with regards to arranging lower costs than those presented in the more customary tenders.

One of the world’s greatest merchants of wheat, Egypt last year began moving towards direct buys rather than tenders after the conflict in Ukraine upset its purchasing.

According to the traders, the General Authority for Supply Commodities (GASC) purchased approximately 480,000 metric tons of Russian wheat from Solaris Trading on Friday for approximately $270 per ton on a cost and freight basis (C&F).

Egypt’s state grains purchaser purchased about a portion of 1,000,000 metric lots of Russian wheat in a confidential arrangement, four brokers told Reuters, prevailing with regards to arranging lower costs than those presented in the more conventional tenders.

One of the world’s greatest merchants of wheat, Egypt last year began moving towards direct buys rather than tenders after the conflict in Ukraine upset its purchasing.

According to the traders, the General Authority for Supply Commodities (GASC) purchased approximately 480,000 metric tons of Russian wheat from Solaris Trading on Friday for approximately $270 per ton on a cost and freight basis (C&F).

The market does not have a clear understanding of the Russian minimum floor price.

Merchants say there are different least costs for private deals and deals openly tenders, as well as various costs for deals in every month among September and December and limits for lower protein wheat grades.

All Russian suppliers had submitted bids in a tender last week at a price floor of $270 per metric ton FOB, with C&F prices ranging from $286.25 to $291 per metric ton.

Dealers told Reuters at the time that this had burdened Russian wheat’s seriousness, with GASC purchasing less expensive Romanian and French wheat all things considered.

GASC had likewise secretly gotten one freight of Bulgarian wheat at $270 per ton C&F on Friday.

After the conflict in Ukraine upset the country’s wheat sends out, Egypt had been predominantly depending on the somewhat modest Russian grain.

Last year Egypt’s stockpile serve said buying straightforwardly from providers empowered it to haggle better costs now and again of vulnerability.

The North African nation has been experiencing an unfamiliar cash smash after the Ukraine war conveyed an expansive shock to its economy, making it begin conceding wheat installments.

The public authority had as of late marked a $500 million credit concurrence with the Abu Dhabi Products Office (ADEX) to purchase imported wheat from UAE-based agribusiness Al Dahra.